Does the look of my invoice really matter? 5 tips to create a professional invoice.

|

|

Tweet |

|

May 14 , 2014

Many small business owners and freelancers make the mistake of believing that because they own a small business, they do not need to have a professional invoice.

Having a professional invoice to be given or sent to your customers not only gives a credibility to your business, but having a prime and proper invoice helps you get paid by your customer efficiently. You can avoid difficulties in the financial side and let your business flow smoothly by having a well organized professional invoices.

Creating an invoice could be not an exciting thing to do and in most cases it can be the worst nightmare for small business owners and freelancers. But the good news that there are a few tips you can flow to make this task fun and easy. Here are a few tips.

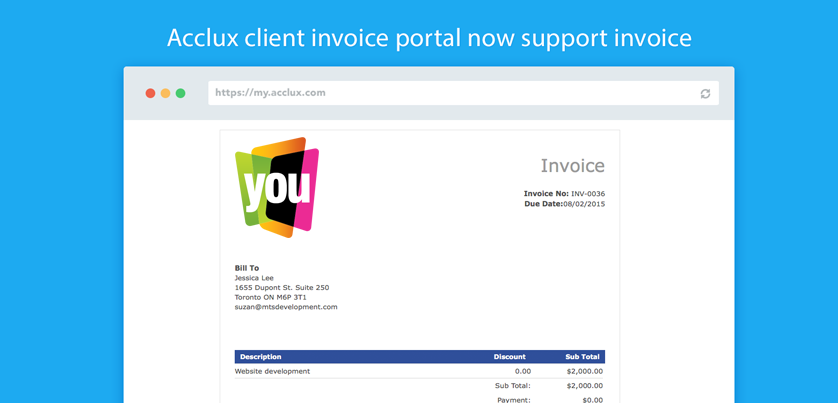

1. Use cool invoicing software that generates professional invoices easily

Having a software that generates professional invoices helps you to create invoices with constant look, this will save your time and carry out the hard job for you, like sequence numbering and you won’t be worried if all the data is included in a proper manner.

Besides, it would be better to have your software on the cloud as it will be easier for you to track your invoices, customers’ payments and money you are owed.

Some online invoicing software like acclux accounting helps you to get paid faster by granting you the choice to send your invoice as email directly from the software. acclux accounting comes with an online payment mechanism which gives your customers an easy option to pay your invoices online. Get more details about acclux accounting here.

2. Include your customer details and yours

Make sure that your invoice not only include your customer address, but it should include a contact name so you can make sure that your invoice won’t misplaced. Also include your company name, your name, address, email address and phone so if your customer has any question about the invoice it will be easy to get hold of you.

3. Have a clear breakdown of your services or items

Your invoices should clearly include a breakdown of the services or items provided and any additional charges associated with your work.Try to make your services description clear as much as you can so your customer can understand what they are being asked to pay.

4. Have your policy cleared

In an ideal world, your invoice should be paid in total and on time but, in the real world this is not the case all the times. Your customer may be late to pay you the invoice or may refuse to complete the payment so you need to have your own policy which make the payment terms clear from the day one of your works like what type of payment method you are accepting, when you should receive your down and final payment, what is the penalties of late payment and so on.

Simply remember, having a policy is not enough, your customers should know about it and you should stick with it no matter what.

5. Let your customers know when and how to pay you.

You have to include the due date for your invoices so your customers know when they should pay you. This will help you to track overdue invoices. Also tell your customers how you wish to pay, are you preferring a mailed check or you prefer an online payment.

Share this article

|

|

Tweet |

|

Articel Tags

acclux accounting Business Freelancers Invoices Tips